Checkout the 2022 New Launches Condo in Singapore

Based on the land sales in 2021, we can do an estimation for possible selling price when the land was bidded, by factoring the developer’s costs (i.e licensing, construction, profits margin…etc). The following chart give a general guideline of the selling pricing across different regions for good size developments. I.e

Out of Central Region (OCR) at $1,9xx psf averagely,

Rest of Central Region (RCR) at $2,2xx psf averagely,

Core Central Region (CCR), at $2,8xx psf averagely.

We provide here a compilation of the upcoming condominiums and apartments, this post will be updated periodically as new information arises. Kindly bookmark it or register interest in the form at bottom, so we can update you the market in timely manner. You could also Whatsapp Us to have the monthly market update send to your whatsapp directly.

Some which are not able to make it in 2022 had launched in the next year instead (2023).

2022 New Launches in Singapore

| District | Project | Address | Tenure | Developer | Unit | Land (psf ppr) |

|---|---|---|---|---|---|---|

| 1 | Former AXA Tower | 8 Shenton Way | 99-yrs | Perennial Holdings | 268 | |

| 1 | Marina View | Marina View | 99-yrs | IOI | 905 | $1379 |

| 1 | Former Maxwell House | Maxwell Road | 99-yrs | Singhaiyi | 250 | $1183 |

| 2 | Former Realty Centre | 15 Enggor St | Freehold | The Place Holdings | 114 | |

| 2 | Former Fuji Xerox | Anson Road | Freehold | CDL | 256 | |

| 3 | Cape Royal | 11 – 25 Cove Way, Sentosa | 99-yrs | Ho Bee Group & IOI | 302 | |

| 5 | Terra Hill (Former Flynn Park) | Yew Siang Road | Freehold | Hoi Hup & Sunway | 270 | $1355 |

| 5 | Blossoms by the Park | Slim Barracks Rise (Parcel A) | 99-yrs | EL | 265 | $1246 |

| 5 | (GLS Parcel B) | Slim Barracks Rise (Parcel B) | 99-yrs | Kingsford | 140 | $1210 |

| 8 | Lavender Residence | 288 Lavender Street | Freehold | FLJ Property Pte Ltd | 17 | |

| 8 | Piccadilly Grand | Northumberland Road | 99-yrs | CDL & MCL | 407 | $1129 |

| 9 | House Hill | 10A &B Institution Hill | 999-yrs | Macly & Roxy Pacific | 72 | $1370 |

| 9 | (3x residential) | 2,4,6 Mount Emily Road | Freehold | ZACD | 18 | $1,115 |

| 9 | (2x residential) | 33 Devonshire | Freehold | Sekon International (S) Pte Ltd | 21 | |

| 9 | Former Fairhaven & Sophia Ville | 130 Sophia Rd | Freehold | Undisclosed | 90 | $1239 |

| 9 | Sophia Regency (Former Casa Sophia) | 105 Sophia Road | Freehold | East Asia Sophia Development | 38 | |

| 9 | Former Peace Center / Peace Mansion | 1 Sophia Road | 99-yrs | CEL/Singhaiyi | 240 | $1428 |

| 10 | (3x terraces) | 6A/B/C Robin Drive | Freehold | Robin Development, | 13 | $1454 |

| 10 | Jervois Prive (former Jervois Green) | 100a Jervois Road | Freehold | Jervois Midas Pte Ltd | 43 | $1601 |

| 11 | Enchante | 1C Evelyn Road | Freehold | Victory Land Pte Ltd | 25 | $1363 |

| 11 | Former Surrey Point | 2 Surrey Road | Freehold | Amara Holdings | 36 | $1434 |

| 11 | Ikigai | 38 Shrewsbury Road | Freehold | Opulent Development Pte Ltd | 16 | |

| 11 | Surrey 21 | 21 Surrey Road | Freehold | Undisclosed | 10 | |

| 11 | Former Watten Estate | Shelford Road | Freehold | UOL | 200 | $1723 |

| 14 | Deluxe Residences | 3 Lorong Melayu | Freehold | Kai Lim Development Pte Ltd | 41 | |

| 14 | Gems Ville (former Yuen Sing Mansion) | 6A-10C Lorong 13 Geylang | Freehold | East Asia Geylang | 29 | $779 |

| 14 | M Suites | 65 Lor Melayu | Freehold | FG Resource Pte. Ltd | 16 | |

| 14 | Mattar Residences | 8 Mattar Road | 99-yrs | FKSH | 26 | |

| 14 | Mill at 32 (Former Leshan Gardens) | Lorong 32 Geylang | Freehold | Undisclosed individual (doctor) | 38 | |

| 14 | (2x private land) | Thiam Siew Avenue | Freehold | Hoi Hup & Sunway | 800 | $1488 |

| 15 | Baywind Residence | 93B/C, 95 Lorong N Telok Kurau | Freehold | ABR & LWH | 24 | $851 |

| 15 | Atlassia | Joo Chiat Road | Freehold | Undisclosed | 31 | |

| 15 | Amber Sea | 30 Amber Gardens | Freehold | Far East | 132 | $1066 |

| 15 | K Suites | 21 to 21E Lorong K Telok Kurau | Freehold | Undisclosed | 18 | $935 |

| 15 | Liv @MB (Former Katong Park Towers) | Arthur Road/Mountbatten Road | 99-yrs | Bukit Sembawang | 298 | $1280 |

| 15 | Royal Hallmark | 1 Haig Lane | Freehold | E2 Holdings | 32 | |

| 15 | Creston Residence | 5 Still Road | Freehold | Melville Pte Ltd | 60 | |

| 15 | Former La Ville | Tg. Rhu Road | Freehold | ZACD | 107 | $1540 |

| 16 | Sky Eden (Former Bedok Point) | Bedok Point | 99-yrs | Frasers | 160 | |

| 16 | Sceneca Residence | Tanah Merah Kechil Link | 99-yrs | MCC Land | 268 | $930 |

| 18 | Tenet EC | Tampines Street 62 | 99-yrs | Qingjian | 590 | $659 |

| 19 | Kovan Jewel (Former Kovan Lodge) | 51A Kovan Road | Freehold | Soon Lian Realty | 34 | $1134 |

| 20 | AMO at Ang Mo Kio | Ang Mo Kio Ave 1 | 99-yrs | UOL | 372 | $1118 |

| 20 | Lentor Modern | Lentor Central | 99-yrs | Guocoland | 605 | $1204 |

| 20 | Copen Grand (EC) | Tengah Garden Walk | 99-yrs | CDL & MCL | 628 | $603 |

| 21 | 8@BT | Jalan Anak Bukit | 99-yrs | FEO and Sino Group | 845 | $989 |

| 23 | The Arden | Phoenix Road | 99-yrs | Qingjian | 105 | |

| 23 | Botany | Dairy Farm Walk | 99-yrs | Sim Lian | 385 | $980 |

| 27 | North Gaia (EC) | Yishun Ave 9 | 99-yrs | Sing Holdings | 617 | $576 |

| 28 | Belgravia Ace (Landed) | Belgravia Ace | Freehold | Tong Eng | 107 | $732 |

| 28 | Pollen Collection (Landed) | Nim Road | 99-yrs | Bukit Sembawang | 132 |

Recapped for the 2021.

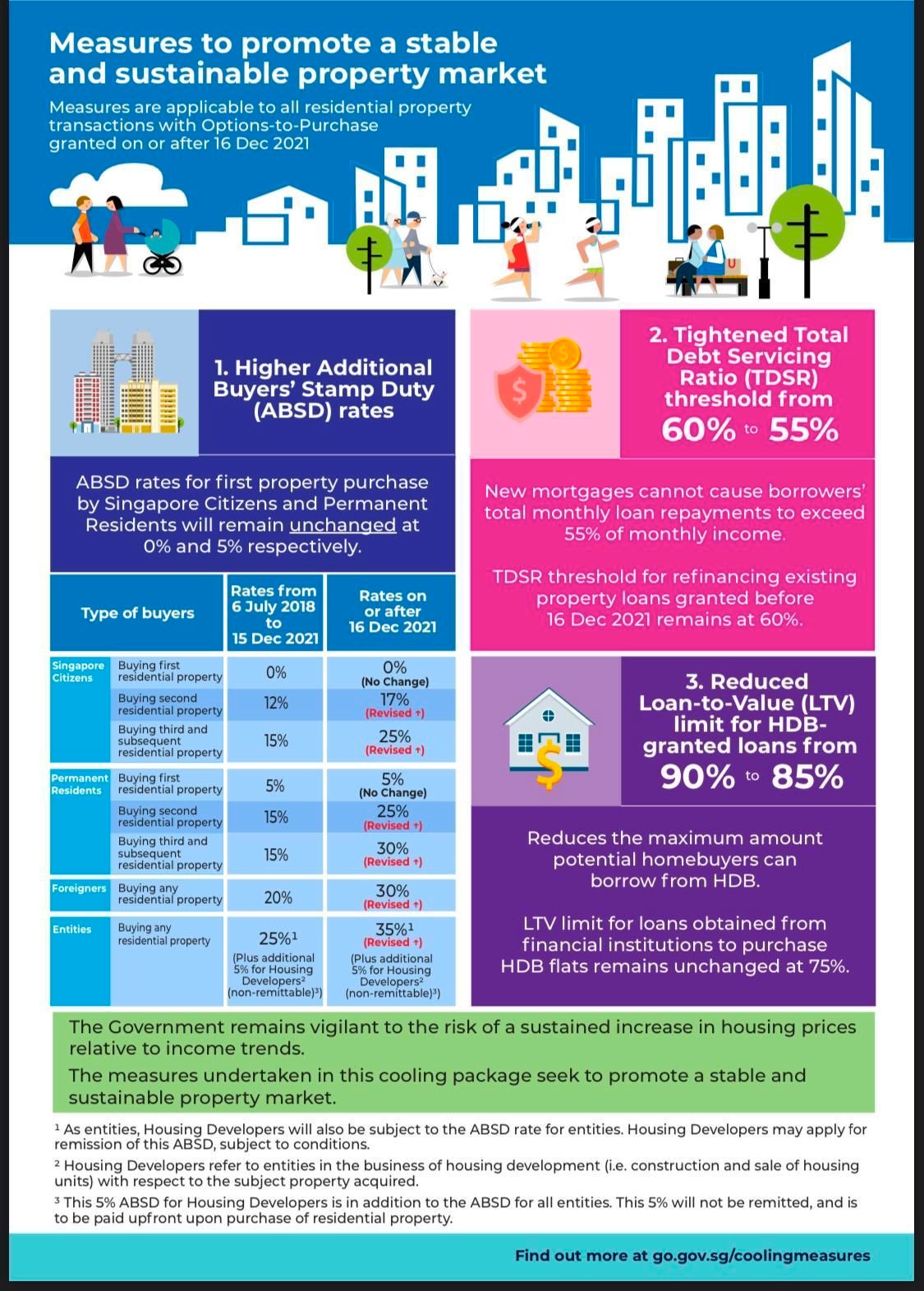

New Cooling Measure 16-Dec 2021

Summarised the Key Pointers here:

a. Tightening of Total Debt Servicing Ratio (TDSR) threshold from 60% to 55% – this means the loan eligibility will be now 8.33% lesser compare to before.

b. Increase ABSD rates 5-10%, except for Singaporean/ PR buying 1st residential property; – developer enbloc cost (entity) will also up 10%.

c. Tighten the LTV limit for loans from HDB from 90% to 85%. – good news is loan from bank is still remains at 75% max.

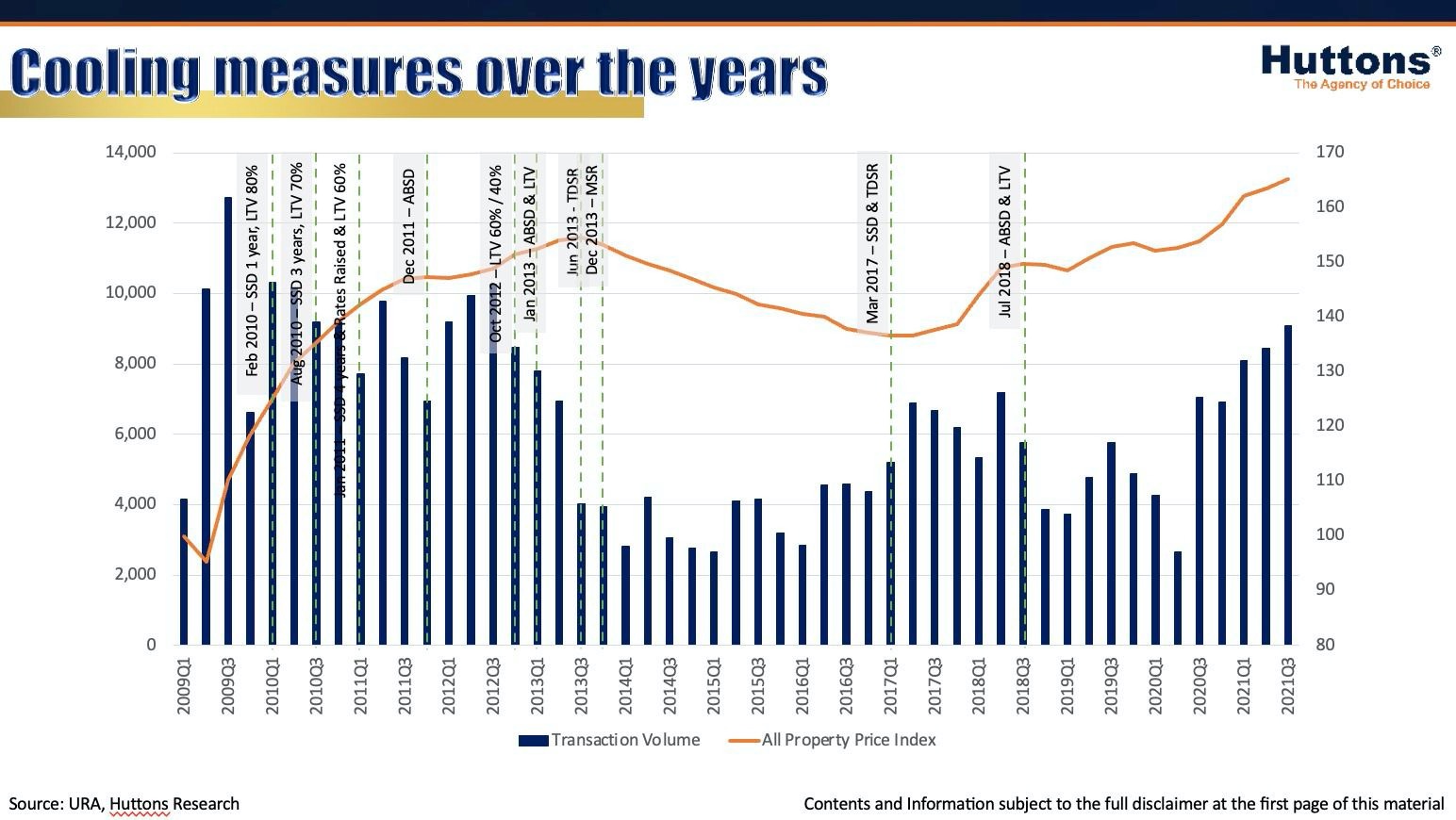

Anyway, we had been go through many rounds of cooling measures since 2010. The following is a quick glance on the cooling measures introduced over the years, vs property price index.

Impact to the market?

Based on experience in last round of “similar” cooling measure in 2018 July, the market is expected to tbe cooled down for at least a 6 months, or so. ? Interestingly, people who took the action right after cooling measures are the one who enjoying the most gain years later. The first 6 months after the new cooling measures introduced are typically the bottom of the market.

As some of the buyers in the market are 2nd/ 3rd time buyers, they will now need to readjust their budget/ expectation due to increased ABSD / lower loan eligibility.

Some who are sitting on the fence will continue to have new excuses to wait & see.

Some 1st property buyer with marginal income/ budget might get phased out from private condo due to lower loan eligibility.

Shall you’re curious how much your loan get impacted because of new age + adjusted TDSR calculation, do let us know, we can help do the calculation for you. ?

Summary

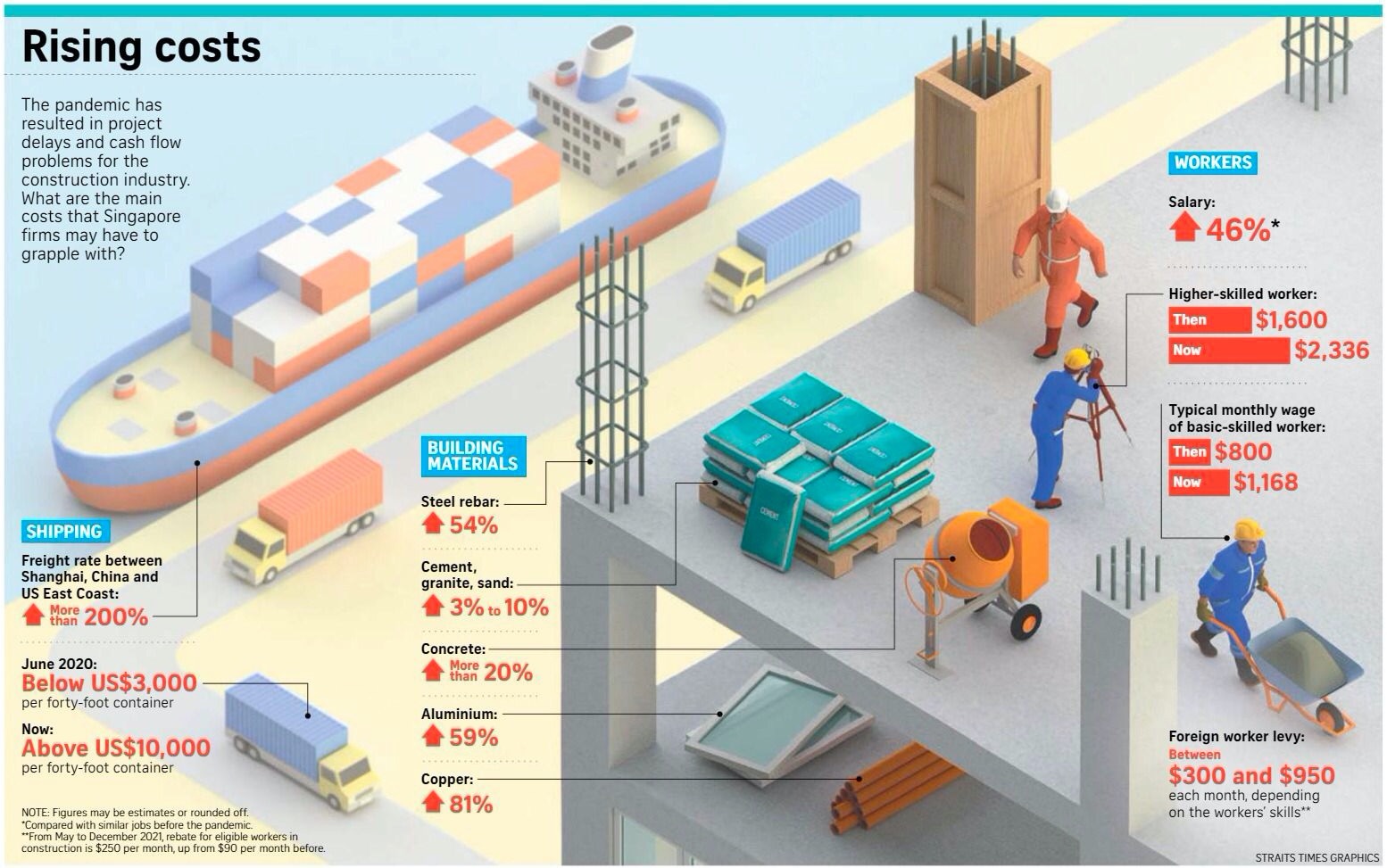

The cooling measures won’t cause the cost of property become cheaper, and developer also limited buffer to adjust. The rising land cost and construction cost are still the key reason driving the property price going north.

This cooling measures will slow down the sales, because some buyers will need more time to adjust budget / expectation, but it will not going to cause the price to drop significantly.

This round is a repeated version of cooling measure introduced in 2018 July, which the property index didn’t drop also, but was get flatten over 2 quarters before it trend upwards again.

In personal view, Singapore property market in 2022 will most likely still quiet in the 1st half, but slowly move upwards in 2022 with the positive news on subsides of covid and international travelling ease.

DBS & Morgan Stanley both predicted in 2018 that Singapore’s property market price to “double” (or averagely $2,900 psf) by 2030, and so far the trend is still holding true. But it’s hard to know how the new cooling measures will affect the market through the upcoming years. Do keep in touch with us, we will keep you updated the market movement & insights for free. Be it you’re ready, or just Wait & See.

Do you plan to buy property in Singapore? Fill in the form below to get in touch with an experienced agent

Alternatively, you can also WhatsApp us for a free consultation if you would like to discuss in details about financing or recommendations of any new launches condominiums and apartments.