Ultimate Guide for Buying Property in Singapore (Local vs Foreigner)

In cities such as Singapore and Hong Kong, property is a hot-button topic with keen interest from both local and foreign buyers. Traditionally, it is also considered one of the safest forms of investment for people to grow their money.

The Singapore Government keeps a close watch on the local property market. While homeowners, property investors, and developers have been directly impacted by the different rounds of cooling measures, it is common knowledge that such initiatives are in place to prevent overexuberance in the industry and the danger of a property bubble forming.

📈 Why Singapore is a Lucrative Choice for Property Investment

There are many compelling reasons that make Singapore a lucrative choice for property investment. It’s no surprise that Singapore’s properties are well-received by foreigners, be it for investment, holiday homes, children’s education, etc. We think here are the top 3 reasons:

🥇 Stable Governance & Economy

Singapore’s property market is established upon stable political governance, sound economic policies and its indisputable position as a commercial trading hub. The local property market is closely monitored by the Singapore government, and initiatives to prevent the formation of a property bubble are well-established. Therefore, foreign investors are assured that the value of their investment in local property will be maintained for years to come.

🥈 Pro-Business & Low-Tax Environment

Singapore’s pro-business and low-tax environment has helped put Singapore on the radar for property investment amongst foreigners. Despite the introduction of the Additional Buyer’s Stamp Duty, the cost will be partially offset by the non-existence of capital gains and inheritance taxes. Additionally, when selling property, the only chargeable tax is the Seller’s Stamp Duty (SSD), which is applicable within the first four years.

🥉 Strength of the Singapore Dollar

The strength of the Singapore dollar can help shield part of one’s portfolio from political instability, thereby offering investors an opportunity for diversification.

✨ Considering Buying Property in Singapore?

With the border reopening, we have seen increasing numbers of foreigner buyers coming back to Singapore’s property market. If you’re a foreigner considering buying property in Singapore, this article is right for you!

🌍 Who is Considered a Foreigner?

A foreign person means any person who is not any of the following:

- Singapore citizen;

- Singapore company;

- Singapore limited liability partnership; or

- Singapore society.

Simply put, you’re considered a foreigner if you are not a Singapore citizen, a Singapore company, a Singapore limited liability partnership or a Singapore association. As such, Singapore Permanent Residents (SPRs) are also considered foreigners.

Singapore Permanent Residents (SPRs) will enjoy lower rates of taxes and also fewer restrictions to buy, e.g., public housing (resale HDB flats/Executive Condominiums), and landed houses (with approval from Singapore Land Authority), which we will elaborate more in the following respective sections.

🏡 What Types of Properties Can Foreigners Buy?

Under the Residential Property Act, a foreigner can buy both public housing and private properties. However, there are restrictions on what foreigners can and can’t buy.

The short answer is that foreigners can largely buy the following property types in Singapore:

- Most condos;

- Some strata landed houses;

- Landed houses on Sentosa;

- An executive condominium that is more than 10 years old.

1. Public HDB Flats

Public Housing Development Board (Public HDB) flats are built with the intention of making affordable housing available to ordinary Singaporeans. Therefore, they are heavily subsidized and regulated by the government, and buyers can further obtain housing grants to fund the purchase. However, Public HDB flats come with strict eligibility requirements that must be met, including forming a family nucleus with a Singaporean/SPR, household income ceiling, requirement to dispose of all properties in Singapore & overseas…etc.

If you’re a foreigner buying alone, you can forget about this.

2. Executive Condominium (EC)

Executive Condominium (EC) is a special segment introduced by the government. Its aim is to cater to the demands of Singaporeans who wish to upgrade to condominium living and yet afford the price of a private condo. ECs are as good as private condos built by private developers but have huge subsidies from the government. Typically, they are about 15-25% lower in price than private condominiums in the market. Thus, the restrictions/eligibility to buy are similar to buying an HDB.

Many Singaporeans use this as a “stepping stone” to upgrade to private condominiums in their young age, and make their first pot of gold. But in reality, the buying eligibility, household income restriction, and bank loan eligibility are always the bottlenecks that stop them.

After 5 years, the EC can be bought by SPRs in the open market without restrictions, but non-SPR foreigners are still not eligible to buy. That’s what we call it “Half Privatised EC”. After 10 years, the EC will reach another milestone – “Fully Privatised EC”. This means the EC now becomes a private condo status and can be bought by non-SPR as well.

If you’re an SPR buying alone, you can buy an EC that is more than 5-years old. If you’re a non-SPR foreigner buying alone, you can only buy an EC that is more than 10-years old after it’s fully privatized.

Listed here in greater detail for different scenarios a foreigner for buying HDB Flats/Executive Condominium:

1. Non-SPR buying alone

You can only buy a private executive condominium (EC) that is more than 10 years old.

2. Singapore PR buying alone

Apart from new HDB flats, Singapore PRs can’t buy a resale HDB flat alone, and can only buy resale ECs that have reached their 5-year Minimum Occupation Period (MOP).

3. Singapore PR jointly buying with another SPR

- A resale HDB flat (3 years after obtaining your PR)

- A resale EC that is more than five years old

- A privatized EC that is more than 10 years old

4. Singapore PR buying with a non-Singapore PR

- A resale EC that is more than five years old

- A privatized EC that is more than 10 years old

5. Jointly buying as a non-Singapore PR couple

- A privatized EC that is more than 10 years old

3. Private Properties

Unlike public housing, private properties have fewer restrictions and are typically more favorable for foreigners buying in Singapore. They also come with better fittings, designs, and are generally closer to the Central Business District (CBD). If you’re buying a private condominium, they also come with facilities such as swimming pools, gyms, saunas, and more.

Here are the common property types that foreigners are eligible to buy:

- Condominium unit;

- Flat unit;

- Strata landed house in an approved condominium development;

- A leasehold estate in a landed residential property for a term not exceeding 7 years, including any further term which may be granted by way of an option for renewal;

- Commercial-use shophouse;

- Industrial and commercial properties; Hotel (registered under the provisions of the Hotels Act); and

- Executive condominium unit, HDB flat and HDB shophouse.

The following properties require approval to purchase:

- Vacant residential land;

- Terrace house;

- Semi-detached house;

- Bungalow/detached house;

- Strata landed house which is not within an approved condominium development under the Planning Act (eg. townhouse or cluster house);

- Shophouse (for non-commercial use);

- Association premises;

- Place of worship; and

- Worker’s dormitory/serviced apartments/boarding house (not registered under the provisions of the Hotels Act).

📞 Seeking Approval for Special Properties?

Approval is on a case-by-case basis. Applicants stand a better chance if they can show proof that they have made an “exceptional economic contribution to Singapore,” as SLA puts it.

For approval applications, you can contact SLA at 6478-3444, or apply online on SLA’s website.

Alternatively, you can visit them at: Land Dealings Approval Unit, Singapore Land Authority, 55 Newton Road, #12-01 Revenue House, Singapore 307987.

Summary: What Singapore PRs and Non-PRs Can Buy

| What Singapore PRs can buy | What non-Singapore PRs can buy |

|---|---|

| Resale HDB flats (with another Singapore PR or Singaporean) | Private condos |

| Resale ECs that has reached their 5-year MOP | Private ECs |

| Privatised ECs | Landed properties in Sentosa Cove |

| Private condos | Landed properties (with special permission from Singapore Land Authority) |

| Strata-landed homes | |

| Landed properties in Sentosa Cove | |

| Landed properties (with special permission from Singapore Land Authority) |

💰 Buyer Stamp Duty (BSD) & Additional Buyer Stamp Duty (ABSD)

Buyer Stamp Duty (BSD) – A Requirement for All Property Buyers

The Buyer Stamp Duty (BSD) is a tax levied on all property buyers regardless of nationality who purchase any property. It is dependent on the purchase price or market value of the property (the ‘Base’). Generally, the more expensive the purchase price or market value of the property, the higher the BSD Rate.

| Purchase Price | BSD Rates |

|---|---|

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining Amount (only for residential properties) | 4% |

Additional Buyer Stamp Duty (ABSD)

The Additional Buyer Stamp Duty (ABSD) is a tax levied on the purchase of residential property and is in addition to the BSD. It is only applicable to the following buyers:

- A Singapore citizen who already has ownership of a residential property and wishes to acquire another;

- A Permanent Resident; or

- A Foreigner.

Essentially, the ABSD affects everyone except Singapore Citizens who are buying their first property.

| Profile of Buyer | ABSD Rates (Effective from 16 Dec 2021) |

|---|---|

| Singapore Citizens (SC) buying first residential property | Not applicable |

| SC buying second residential property | 20% |

| SC buying third and subsequent residential property | 30% |

| Singapore Permanent Residents (SPR) buying first residential property | 5% |

| SPR buying second residential property | 30% |

| SPR buying third and subsequent residential property | 35% |

| Foreigners (FR) buying any residential property | 60% |

| Entities buying any residential property | 65% |

Any transfer of residential property into a living trust will be subject to an ABSD rate of 65%.

| Profile of Buyer | ABSD Rates |

|---|---|

| Trustee buying any residential property | 35% |

✨ Special Case: ABSD Waiver/Refund for Married Couples

If you are a foreigner or Permanent Resident with a Singaporean spouse and both of you do not own any residential property in Singapore, the ABSD will be waived for your first matrimonial home. It can also be refunded if you are switching your first matrimonial home as a married couple. However, the existing property must be sold within six (6) months after the date of purchase of the second property (if completed); or ii) Temporary Occupation Permit (whichever is earlier).

🤝 Foreigners Eligible for ABSD Remission under Free Trade Agreements (FTAs)

Good news if you are Nationals of the United States of America, or Nationals/PR of Iceland, Liechtenstein, Norway and Switzerland!

Under the respective FTAs, Nationals or Permanent Residents of the following countries will be accorded the same Stamp Duty treatment as Singapore Citizens:

- Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland

- Nationals of the United States of America

You will be granted the same tax treatment as Singapore Citizens. Therefore, the ABSD will not be applied on your first residential purchase, and your second, third & subsequent residential purchases will be taxable at 17% and 25% respectively.

🧾 What Property Taxes Do Foreigners Have to Pay?

Property tax is a wealth tax levied on property ownership. It is not a tax on rental income. It is thus levied on the ownership of properties, irrespective of whether the property is occupied or vacant.

The property tax is calculated by multiplying the Annual Value (AV) of the property with the prevailing property tax rate.

Every property has an AV. This AV of a property is determined based on market rentals of similar or comparable properties. What this means is that if you own a five-room flat in Toa Payoh, the Inland Revenue Authority of Singapore (IRAS) looks at similar five-room flats in Toa Payoh and how much they are rented out at, to determine the Annual Value, i.e., monthly rental x 12 months.

The formula looks like this:

The AV of a property might vary from year to year, so will your property taxes. It’s worth noting that when areas get new amenities and rental prices go up, so will your AV and property tax. Similarly, when the market is down, your AV will go down too, and along with it the amount of property tax you have to pay.

Whenever your AV has changed, the Inland Revenue Authority of Singapore (IRAS) will send you a notification regarding the revision. You can also log in to the IRAS myTax Portal to check on the AV of your property any time.

If your AV is reassessed, and you disagree with it, you can submit an objection. You should do so within 30 days from the date of the valuation notice. You cannot however object the tax rate itself.

If you wish to view the AV of a property before buying it, you can do so with the Check Annual Value of Property service. Take note that each search costs S$2.50 inclusive of GST.

Property Tax Rates

Your tax rate is dependent on factors such as your Annual Value and whether you live in the property yourself. Basically, the higher the AV of your home, the higher the tax rate. The idea is to tax the wealthy more. Hence, properties that are not owner-occupied have a higher progressive tax rate. This is logical as those who own property they don’t live in (whether it’s rented out or vacant) are deemed to be wealthier.

Following the latest announcement on Singapore Budget 2022, property tax will be adjusted marginally in two steps, i.e., in 2023 and 2024. The real impact of this increment will be on the luxury property segment, which have a very high AV. For reference, a Good Class Bungalow had hit S$200,000 rental per month, or S$2.4mil a year.

Owner-Occupier Tax Rates

Let’s get down to the numbers. If you are an owner-occupier, the following tax rates apply to you.

Rates Before 2023

| Annual Value (AV) | Tax Rate |

|---|---|

| Up to S$8,000 | 0% |

| Next S$20,000 | 4% |

| Next S$12,000 | 6% |

| Next S$12,000 | 10% |

| Above S$52,000 | 12% |

Rates From 1 Jan 2023

| Annual Value (AV) | Tax Rate |

|---|---|

| Up to S$8,000 | 0% |

| Next S$22,000 | 5% |

| Next S$14,000 | 9% |

| Next S$16,000 | 15% |

| Next S$16,000 | 21% |

| Above S$76,000 | 23% |

Rates From 1 Jan 2024

| Annual Value (AV) | Tax Rate |

|---|---|

| Up to S$8,000 | 0% |

| Next S$22,000 | 6% |

| Next S$14,000 | 10% |

| Next S$16,000 | 18% |

| Next S$16,000 | 26% |

| Above S$76,000 | 32% |

In Singapore, owner-occupier property tax rates range from 0 to 32% eventually. As can be seen from the table, owner-occupied homes with an AV of S$8,000 and below are exempted from paying property tax.

If the above table is a bit confusing, let us work out an example which tax rate you should use as an owner-occupier.

Example: Property with AV of S$105,000 (appraised monthly rental of S$8,750)

Before 2023:

- First S$100,000 = S$5,480

- Remaining S$5,000: 12% = S$600

- Total property tax payable: S$5,480 + S$600 = S$6,080

Starting 1st Jan 2023:

- First S$100,000 = S$8,730

- Remaining S$5,000: 23% = S$1,150

- Total property tax payable: S$8,730 + S$1,150 = S$9,880

Starting 1st Jan 2024:

- First S$100,000 = S$11,980

- Remaining S$5,000: 32% = S$1,600

- Total property tax payable: S$11,980 + S$1,600 = S$13,580

Instead of doing it manually, you can just use the property tax calculator on IRAS to calculate your property tax.

Non-Owner-Occupier Tax Rates

If you own property within which you do not reside yourself (be it rented out or vacant), then these higher tax rates apply to you, the non-owner-occupier.

Rates Before 2023

| Annual Value (AV) | Tax Rate |

|---|---|

| Up to S$30,000 | 10% |

| Next S$15,000 | 12% |

| Next S$15,000 | 14% |

| Next S$15,000 | 16% |

| Above S$75,000 | 18% |

Rates From 1 Jan 2023 Onwards

| Annual Value (AV) | Tax Rate |

|---|---|

| Up to S$30,000 | 11% |

| Next S$15,000 | 14% |

| Next S$15,000 | 20% |

| Next S$15,000 | 28% |

| Above S$75,000 | 36% |

Non-owner-occupier property tax rates range from 10 to 36% eventually. In case you’re wondering if you can be the owner-occupier of two homes, the answer is no, you can only be listed as the owner-occupier in one home.

And don’t try to outsmart IRAS. For a married couple who choose to decouple and own two properties under individual names, the owner-occupier tax rates will still only apply to ONE property.

💡 Deceased Property Ownership & Tax Rates

On a more sombre note, a property owned by a person who is deceased is technically considered a non-owner-occupied property. However, IRAS will apply owner-occupier tax rates for an extended period of up to either two years from the owner’s passing or the date of transfer of the property, whichever is earlier. Further requests for extension may be submitted on appeal.

⚠️ Falsifying Information to Avoid Higher Tax

A person who owns both an HDB and a private property, and rents out the private property while still claiming that they live there as an owner-occupier, may be subject to investigation and prosecution if they are found to be deliberately falsifying information to avoid a higher tax.

In any case, once you have rented out a property, IRAS will know because the stamp duty of the rental has been paid. The owner-occupier tax rates are no longer applicable for that property from the date of rental.

Commercial and Industrial Properties (Non-Residential)

Non-residential properties such as commercial and industrial buildings and land are taxed at 10% of the Annual Value. Owner-occupier tax rates do not apply to non-residential properties even if you have bought the properties for your own use/occupation.

Property tax in Singapore is due on 31st January every year.

In the event that you are late, a 5% penalty is imposed on the unpaid tax. If you have submitted an objection and are still waiting for the outcome, you’ll still have to pay the tax. If there’s any revision, you’ll be refunded for the excess payment.

In the event that you have failed to pay tax even after the penalty has been issued, IRAS can appoint agents like your bank, employer, tenant or lawyer to recover the overdue tax. Worse still, they may put up your property for auction to recover the unpaid tax.

Income Taxes on Rental Income for Foreigners 🏘️

Be it you are a foreigner or local, everyone has to pay “Income Tax”.

Property tax is imposed based on ownership of property, while income tax is being taxed on the rental income earned. Hence, you are not being taxed twice for ownership of property.

The tax rate for non-resident individuals is currently at 22%. It applies to all income including rental income from properties, pension and director’s fees, except employment income and certain income taxable at reduced withholding rates. For more info, refer to IRAS: Individual Income Tax Rate.

New! From YA 2024, the income tax rate for non-resident individuals (except on employment income and certain income taxable at reduced withholding rates) will be raised from 22% to 24%. This is to maintain parity between the income tax rate of non-resident individuals and the top marginal income tax rate of resident individuals.

✅ Good News: Deductible Expenses!

Only the net rental income after deduction of any allowable expenses is subject to income tax. These expenses are incurred solely for producing the rental income and during the period of tenancy, and may be claimed as tax deduction, including:

- Bank loan interest

- Property Tax

- Fire Insurance

- Repairs & Maintenance

- Furniture

- Management cost, utilities bill, internet bill etc.

Selling Your Property: Capital Gains, Inheritance, and Seller’s Stamp Duty (SSD) 💰

Capital Gain Tax / Inheritance Tax

Good news! There are no capital gain tax or inheritance tax payable in Singapore, whether you are foreign or local. However, note that there is a Sellers Stamp Duty (SSD) aimed to prevent speculation. It only applies for three years, and affects foreigners and locals alike.

Seller Stamp Duty (SSD)

The seller pays stamp duty of 4% to 16% on transfers of residential properties if disposed of within 4 years of acquisition. The applicable stamp duty rate varies, depending on the holding period of the property. In most instances, the date of purchase/acquisition of a property refers to:

- Date of Acceptance of the Option to Purchase* or

- Date of Sale and Purchase Agreement or

- Date of Agreement for Lease (for new HDB flat) or

- Date of Transfer where the above (a), (b) and (c) are not applicable

*Excludes an Option to Purchase that is subject to the execution/signing of the Sale and Purchase Agreement

| Holding Period | SSD Payable |

|---|---|

| Up to 1 year | 16% |

| More than 1 year and up to 2 years | 12% |

| More than 2 years and up to 3 years | 8% |

| More than 3 years and up to 4 years | 4% |

| More than 4 years | No SSD payable |

SSD is computed by applying the requisite SSD rate on the higher of the selling price or the market value of the residential property as at the date of sale or disposal.

💡 New Launch Condo Investment Tip!

A typical new launch construction period is about 3.5 to 4 years. For investors buying into new launch condos, the 4-year SSD period would “about to pass” when the building is completed. Thus, they can sell it without incurring SSD if time it correctly.

Can Foreigners Apply for Bank Loans from Singapore Banks? 🏦

Yes. Foreigners can indeed apply for mortgages in Singapore. Regardless of nationality, there are limits on the loan to value (LTV) ratio of your mortgage, as well as mandated minimum cash down payments. This is set by the Monetary Authority of Singapore (MAS).

As for foreigners buying property in Singapore with income generated overseas, you will face more stringent requirements (e.g., translation of documents / proof of sources of fund / certified true copy) to secure the same LTV as local residents. If you’re working in an established company, e.g., a Multinational Company (MNC), it will help a lot too!

As part of the cooling measures in the residential property market, the maximum loan to value ratio is 75% for a first home loan (but depending on your age and the tenure of your loan, it can be as low as 55%). The cash downpayment required is typically 5% (but, similarly, it can be as much as 25%). If you’re getting a 2nd or 3rd home loan in Singapore, the LTV will be significantly reduced as illustrated by the following chart. This is to ensure a healthy debt ratio for every buyer, and prevent property bubbles from forming.

Note that, commercial/industrial property is not subjected to cooling measures, therefore buyers do not need to pay ABSD and LTV for commercial property can be higher than 75% set for residential property.

In short, for a foreigner (non-SPR) buying a 1st residential property in Singapore, and assuming you manage to secure a 75% bank loan:

Loan To Value (LTV) for Singapore Private Condo Purchase

| Loan Type | Max LTV | Min Cash Downpayment |

|---|---|---|

| First Housing Loan | Up to 75% | 5% |

| Second Housing Loan | Up to 45% | 25% |

| Third Housing Loan | Up to 35% | 25% |

🧮 Use Our Affordability Calculator!

You can use our all-in-one calculator to get an idea of how much you can loan, the downpayment required, mortgage installment, or what’s the minimum income required for a certain purchase price etc.

Where Should I Buy as a Foreigner? CCR, RCR, OCR Explained 📍

Depending on whether you are buying the property for own stay or investment, location plays an important role. Properties in prime districts retain their value very well and they usually have the highest capital gain in a bullish property market. Properties in the suburbs are lower in price and may be more suitable for own stay than investment.

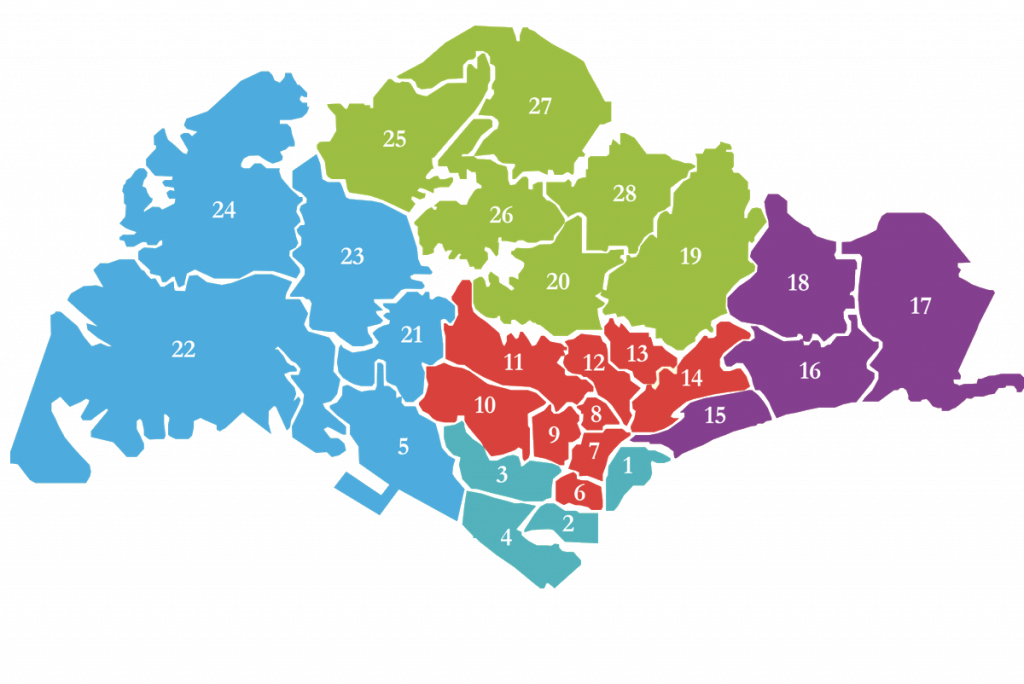

Let’s take a look at the Singapore Map first:

Like many other countries, the country is divided into “districts”. In Singapore, there are a total of 28 Districts in this small island. However, the numbering of districts doesn’t represent the popularity or property price. For example, District 1 doesn’t mean it’s a more expensive district than District 2.

These districts are further categorised into 3 regions by Urban Redevelopment Authority (URA), i.e:

- Core Central Regions (CCR)

- Rest of Central Regions (RCR)

- Outside Central Regions (OCR)

This is a more meaningful term to define the prime areas/property price range of Singapore. However, some districts fall into the boundary of the region, which means a same district could have areas belonging to 2 different regions. For example, part of District 05 is within RCR, and the rest of it is OCR. The boundary defining RCR and OCR in District 05 is the Clementi Road.

Singapore Districts & Property Zones

| Zone | District | Postal Codes beginning with | Location |

|---|---|---|---|

| City/ CCR | 1 | 01, 02, 03, 04, 05, 06 | Boat Quay, Cecil, Havelock Road, Marina, People’s Park, Raffles Place, Suntec City |

| City/ CCR | 2 | 07, 08 | Anson, Shenton Way, Tanjong Pagar |

| South/ CCR & RCR | 3 | 14,15, 16 | Alexandra, Queenstown, Redhill, Tiong Bahru, Chinatown. [Boundary: Maxwell Rd] |

| South/ RCR | 4 | 09, 10 | Harbourfront, Keppel, Sentosa, Telok Blangah |

| West/ RCR & OCR | 5 | 11, 12, 13 | Bouna Vista, Clementi, Dover, Hong Leong Garden, Pasir Panjang, West Coast. [Boundary: Clementi Rd] |

| City/ CCR & RCR | 6 | 17 | Beach Road (part), City Hall, High Street, North Bridge Road. [Boundary: Hill St.] |

| City/ CCR | 7 | 18, 19 | Beach Road, Bencoolen Road, Bugis, Golden Mile, Middle Road, Rocher. |

| Central/ RCR | 8 | 20, 21 | Farrer Park, Little India, Serangoon Road |

| Central/ CCR | 9 | 22, 23 | Cairnhill, Killiney, Orchard, River Valley |

| Central/ CCR | 10 | 24, 25, 26, 27 | Ardmore, Balmoral, Bukit Timah, Grange Road, Holland Road, Orchard Boulevard, Tanglin |

| Central/ CCR | 11 | 28, 29, 30 | Chancery , Dunearn Road, Moulmein, Newton, Novena, Thomson, Watten Estate, Novena |

| Central/ RCR | 12 | 31, 32, 33 | Balestier, Toa Payoh |

| East/ RCR | 13 | 34, 35, 36, 37 | Braddell , Macpherson, Potong Pasir |

| East/ RCR | 14 | 38, 39, 40, 41 | Eunos, Geylang, Kembangan, Paya Lebar, Sims |

| East/ RCR & OCR | 15 | 42, 43, 44, 45 | Amber Road, East Coast, Joo Chiat, Katong, Marine Parade, Meyer, Tanjong Rhu. [Boundary: Still Road] |

| East/ OCR | 16 | 46, 47, 48 | Bayshore, Bedok, Chai Chee, Eastwood, Kew Drive, Upper East Coast |

| East/ OCR | 17 | 49, 50, 81 | Changi, Flora, Loyang |

| East/ OCR | 18 | 51, 52 | Pasir Ris, Simei, Tampines |

| North/ RCR & OCR | 19 | 53, 54, 55, 82 | Hougang, Punggol, Sengkang, Serangoon Garden. [Boundary: Bartley East Road] |

| North/ RCR & OCR | 20 | 56, 57 | Ang Mo Kio, Bishan, Braddell, Thomson. [Boundary: Ang Mo Kio Ave 1] |

| West/ RCR & OCR | 21 | 58, 59 | Clementi Park, Hume Avenue, Ulu Pandan, Upper Bukit Timah, Beauty World. [Boundary: PIE & Upper Bukit Timah Rd] |

| West/ OCR | 22 | 60, 61, 62, 63, 64 | Boon Lay, Jurong, Tuas |

| West/ OCR | 23 | 65, 66, 67, 68 | Bukit Batok , Bukit Panjang, Choa Chu Kang, Dairy Farm, Hillview |

| West/ OCR | 24 | 69, 70, 71 | Lim Chu Kang, Sungei Gedong, Tengah |

| North/ OCR | 25 | 72, 73 | Admiralty Road, Kranji, Woodgrove, Woodlands |

| North/ OCR | 26 | 77, 78 | Springleaf, Tagore, Upper Thomson |

| North/ OCR | 27 | 75, 76 | Admiralty Drive, Sembawang, Yishun |

| North/ OCR | 28 | 79, 80 | Seletar, Yio Chu Kang |

Traditionally, based on statistics, wealthy foreigners are mostly buying in prime districts like district 09, 10, 11 or the Central Business District (CBD). They want the best of the best in Singapore.

With the property prices in Singapore getting highly appreciated over the years and the hike in taxes for foreigners buying property in Singapore, there is an increasing number of foreigners buying into city fringe areas, where they could enjoy a lower entry price and yet still be close to CBD. Properties with sea views at the East Coast are also highly in demand as a resort home or investment.

Most Popular (and Priciest) Locations for Foreign Buyers

🌆 Orchard

Orchard Road is always buzzing with activity and is literally the heart of Singapore. From upscale shopping centers to gastronomic dining experiences, everything you ever need is right at your doorstep. The centrality of the location also provides access to excellent public transport links and places you in close proximity to the Central Island Expressway and Central Business District. Living in the area may come with a hefty price tag but you can be assured that the advantages of doing so makes everything worthwhile.

🌳 Tanglin

If you prefer to escape from the hustle and bustle of city life, Tanglin Road’s the area for you. Being an older and more established area, the properties range from spacious houses with huge garden fronts to low-rise condominiums. While bringing nature closer to you, the area also provides convenient access to central areas of Singapore, such as Orchard Road. Additionally, Dempsey Hill, a stone’s throw away, houses art galleries, restaurants, and cafes for you to unwind and relax.

🍽️ Holland Village

Holland Village’s laid-back bohemian vibe and diverse dining selection makes it a classic favorite amongst expats. Enjoy a variety of delicious local fare in the large hawker centre or head to nearby Jalan Merah Sega for more shopping and dining. The Circle Line right at your doorstep takes you to various parts of Singapore in the shortest time possible.

🏫 Bukit Timah

The benefits of living in this area include being in close proximity to several international schools and social clubs such as the Japanese Association, British Club, and the Bukit Timah Saddle Club. You may choose to live in one of the many properties that Sixth Avenue has to offer, from family houses with gardens to luxe condominiums.

🌊 Robertson Quay

Robertson Quay is an obvious choice amongst younger expats who seek to enjoy the vibrant nightlife offered by the row of restaurants and bars facing the Singapore River. Robertson Quay houses several ritzy new condominiums that offer splendid views of the River. On the other side of Robertson Quay sits UE Square, a huge residential, commercial, and retail complex.

🏖️ Sentosa

Sentosa Island houses some of the most luxurious sea-facing homes in Singapore. Residents also get to enjoy a plethora of recreational activities and attractions or bask in the sun at one of the many beaches without having to leave the island. At the gateway of Sentosa stands Singapore’s largest shopping mall, Vivocity, offering a dizzying array of retail and dining options. Therefore, many expats who desire an extravagant and unique way of living have made Sentosa Island their home.

🌅 East Coast

East Coast is regarded as the most beautiful coastal line of Singapore. Traditionally, it’s famous for its freehold status, sea view, and also plenty of foods and good schools. It’s close to CBD but lacked transportation options (no MRT). However, with the introduction of the new MRT in 2016 – Thomson East Coast Line, which runs through the East Coast area, it has further enhanced the connectivity of the area, making it one of the most popular choices since then.

Hope the above gives you some ideas where to start looking for your property in Singapore! As for all existing new launch properties, you can checkout Singapore Existing New Launches. Or if you’re looking for an upcoming one, you can checkout Most Complete List of New Launches in Singapore.

Shall you have any doubts, or seeking for 3rd party opinions before committing to a purchase, you can always reach out to us. We’re a team of licensed, professional real estate consultants in Singapore who can provide you more insightful information. We’re well-versed in English, Mandarin, Bahasa, and dialects (Cantonese & Hokkien).

What is the Property Buying Process in Singapore? 📝

By now, you have a general idea of Singapore’s property market, what you can buy, and where to buy. The next step is to understand the process before you commit to purchasing property in Singapore.

1. Use the Affordability Calculator

Here, you can use our Singapore Bank Loan Eligibility Calculator to check the maximum property affordability based on current government regulations and property cooling measures. This will only take around five minutes.

2. Check If You Need to Pay Taxes

Foreigners are required to pay Additional Buyer’s Stamp Duty (ABSD) when buying private property in Singapore, except for US nationals or nationals and Permanent Residents from Switzerland, Liechtenstein, Norway and Iceland, buying their 1st property in Singapore.

Not forgetting also, you need to pay a Buyer’s Stamp Duty (BSD), Legal fee and Mortgage Duty if taking a bank loan to fund the purchase. All this shall be taken into consideration to finalize your target purchase price to ensure you do not overstretch your financing.

3. Go Through The Listings

For resale listings, PropertyGuru is the most popular property portal in Singapore. It provides a comprehensive selection of resale HDB flats, ECs and private condos to suit your budget and desired location.

As for existing new launch properties, you can checkout Singapore Existing New Launches. Or if you’re looking for an upcoming one, you can checkout Most Complete List of New Launches in Singapore.

As a general guide, you should consider proximity to nearby amenities, MRT stations, parks, economic drivers and ease of commuting to work as part of your selection criteria.

4. Hire an Agent (Optional, but Recommended!)

This is optional. But truly, an agent can help you scout for the best deals, do your financial calculations, settle your paperwork and other nitty-gritty details. They will typically charge an agent fee of 1% for resale property, and the amount of work/time/saving from price negotiation you save is typically much more than this 1% fee.

As for new launches under construction, we are appointed as the direct representative of developers for all the projects available in the market. You can look for us, and what’s best is that you DO NOT need to pay agent commission. Rest assured, you enjoy the direct price and discount directly from developers.

5. Apply for a Bank Loan

Foreigners are eligible for a bank loan in Singapore. You can get up to 75% financing on the property’s purchase price for the first property and 55% for the second and subsequent property. Bank loans are subjected to floating rates, meaning their interest rate can go higher or lower.

We do have long-term partnerships with various major banks in Singapore. You could enjoy the best rate through our connection/referral to them. We also have partners to assist you in setting up family offices or getting privileged bank accounts for HNW customers. Don’t hesitate to ask us on this!

6. Make an Offer and Seal the Deal

Now that you have found your dream property in the HDB or private property market, it is time to seal the deal.

If you’re getting a HDB resale flat, I assume you’re at least a Singapore PR; you should have good knowledge of this from your agent or research. If you’re DIY, you will need to log into the HDB Resale Portal with your SingPass to complete it step by step. As the title goes, I shall put focus more on Foreigner Buying Property in Singapore, which is likely a condominium in most cases.

Condominium Purchase Process: Resale vs. New Launches

1. Securing the Unit (Option Fee)

For Resale:

- 1% of the purchase price, along with an “Offer to Purchase”.

- Seller will issue “Option to Purchase (OTP)” if accepted your offer.

- This could take days to weeks depending on price negotiation and T&Cs.

For New Launches:

- 5% of the purchase price.

- Price is transparent and pretty much fixed (no harm to try negotiating!).

- Developer will issue the OTP on the spot in most cases. OTP is a standard government document (Controller of Housing – COH).

2. Exercising the OTP

For Resale:

- Exercise within 2 weeks in a law firm, with an additional 4% options exercise fee.

- If you miss/change your mind, the seller can forfeit your 1% Option Fee.

- Try to settle the bank loan before the OTP deadline.

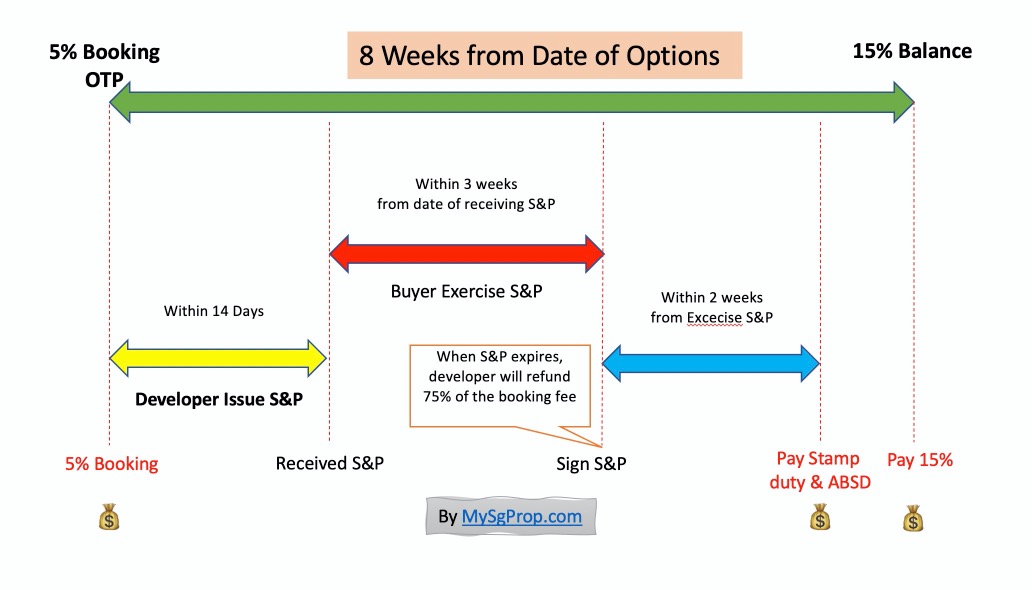

For New Launches:

- Developer sends Sales & Purchase Agreement (S&P) to your law firm within 2 weeks.

- You have 3 weeks to exercise it after receiving S&P (max 5 weeks total).

- You do not need to pay anything when exercising.

- If you miss/change your mind, the developer can forfeit 25% of your Option Fee (i.e., 1.25% of purchase price). The remaining 75% will be refunded.

3. Paying Stamp Duty & ABSD

For Both Resale & New Launches:

- You will need to pay within 2 weeks from the date you exercise the OTP.

4. Balance Payment

For Resale:

- This happens within 8-12 weeks after exercising the OTP.

- Lawyer will invite you once it’s ready. If not taking a loan, you settle the 95% balance payment on this day.

For New Launches:

- On top of your 5% Option Fee, you still have a balance of 15% to be paid within 8 weeks from the OTP issued date (not exercise date!).

- If you’re not taking a loan, you will need to pay the bill progressively according to the construction stages (see diagram below).

If you’re an investor getting a new launch, you probably only need to worry about the first 60% which doesn’t able to generate any income because it’s still under construction. You will get your key at TOP (Temporary Occupation Permit) stage, which you can rent it out to generate passive income. Singapore’s rental market is on the rise and always has strong demands; in most cases, you would still have positive income after deduction of mortgage payment.

For your info, we would typically be able to get in a tenant within a month. That’s how strong the rental demands in Singapore are.

📝 Key Takeaways for Foreign Property Buyers in Singapore

Finding and buying a house in Singapore can be complicated — especially for expats, as there are restrictions on the way that foreigners can buy both land and property. However, the mind-boggling amount of information on the internet may be daunting, especially if you’re a foreigner making your first property purchase in Singapore. When diving into the property market in Singapore, take this guide as your starting point.

Buying a property is always a bit of a leap in financial commitment, and being informed about taxes payable is always vital as it’s part of the cost of property ownership. To avoid falling foul of scams and pitfalls, you’re strongly recommended to go after a local trusted agent’s help and advice for a hassle-free purchasing process. Although there will be a fee to pay for this service, they’ll help you with avoiding costly mistakes, and might be able to negotiate with the seller better than you can alone.

At MySgProp.com, your interests are our number one priority. Let us help you make your purchase decision by getting in touch with us – we are more than happy to be at your service and to provide you with any property information you require to make a better decision as well as any latest property launches.

Shall you have any doubts, or seeking for 3rd party opinions before committing to a purchase, you can always reach out to us. We’re a team of licensed, professional real estate consultants who can provide more insights. We’re well-versed in English, Mandarin, Bahasa, and dialects (Cantonese & Hokkien).

Whatsapp: +65.84188689

Line/ WeChat ID: mysgprop

Hi, I’m CS Tee from MySgProp.com, a CEA-licensed real estate advisor in Singapore since 2012.

Beyond helping clients buy, sell, or rent local properties, I also work with developers on new launches across Malaysia, Indonesia, Thailand, Vietnam, Cambodia, the UK, Australia, and Dubai.

If you/ friends need any assistance with property matters, feel free to reach out.